The construction sector contracted by 27.4 per cent year-on-year in Q4 2020 due to declines in both public and private sector construction works, and this was already an improvement from the 52.5 per cent contraction recorded in the third quarter. Now, the questions are about the outlook in 2021 and the strategies that we can implement to deal with the challenges.

Read: Construction shrank by 35.9 per cent in 2020; GDP growth is forecasted at 4 to 6 per cent in 2021

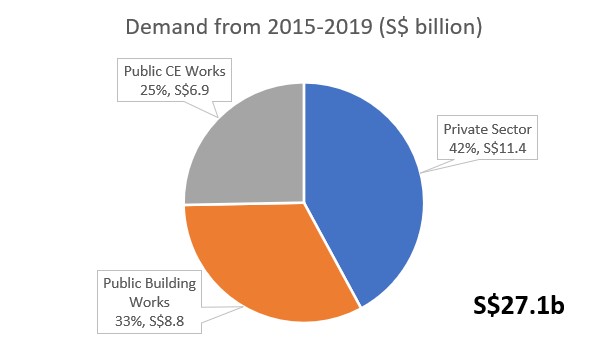

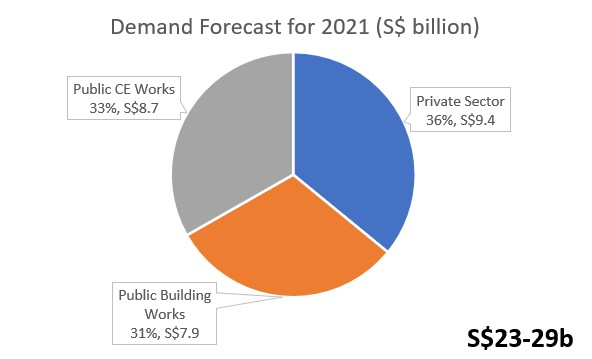

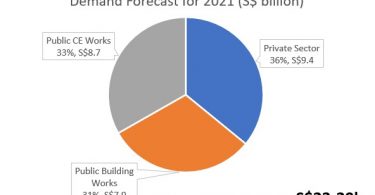

Construction+ attended the built environment and property prospect seminar held by Building and Construction Authority (BCA) and made note of some pointers given by Silas Loh, Joint Managing Partner at Rider Levett Bucknall (RLB) in his keynote speech. On the one hand, we could be optimistic that the value of demand in 2021 will return to its former state before the COVID-19 hit the sector, as shown in the estimate below:

But on the other hand, a survey with Singapore contractors on their forecast of the impact of COVID-19 on tender prices for the year 2020 shows that:

- 60 per cent of them believed that labour cost will increase by at least 10 per cent;

- 75 per cent indicated that material costs’ increase will range from 5 to 15 per cent,

- 75 per cent thought that costs for preliminaries and supervision will increase by 5 to 15 per cent; and

- 55 per cent believed that the profit margins will see up to 5 per cent reduction.

The majority of them were certain that the overall tender price will rise, with some believing it to be between 5 and 10 per cent and some predicting it to be over 10 per cent. Other quantity surveying (QS) consultancy firms in Singapore have also conducted their independent research. The results were in line with the survey by RLB—that the tender price index (TPI) for the year 2021 will increase; and below is the list of firms with their predicted TPI:

- Aecom: 2 to 4 per cent

- Wolferstand Trower: 0 to 5 per cent

- Surbana Jurong: 5 to 10 per cent

- Turner & Townsend: 6 to 10 per cent

- Arcadis: more than 10 per cent

The ranges vary because they used different means and analysis, with some grounding it in the market trends while others used a more empirical approach such as stakeholders’ interviews. Either way, the findings clearly show that the construction cost trend has been going upward and will not go down anytime soon this year.

If we compare data from the last 15 years about output/demand and TPI, there is usually a strong correlation between the two—when there are a lot of demands, the cost goes up; and when there are fewer demands; the cost goes down. We could almost always predict construction cost by looking at the demand because it is usually consistent. But in 2020, there was anomaly in the pattern: the demand dropped, which means there were fewer tenders, but the cost went up.

Key factors that may have affected price movements include:

- The increase in material and labour costs due to shortage and stiff global competition for resources;

- Uncertain market conditions;

- A possible increase in firm insolvencies as government support eased after 1Q 2021; and

- A limited pool of competent contractors for the upcoming projects.

Meanwhile, the cost drivers include:

- Commodity price trends that have gone up substantially;

- Labour crunch;

- Stalling skill test stations; as well as

- Stringent requirements in procedures, testings and quarantines.

Even when the labour crunch eases, it will take at least three months for tender prices to stabilise.

Read: On-arrival tests for newly arrived foreign construction workers in Singapore

Labour supply sub-contractors have also been quoting 20 to 30 pe cent of increment in tender prices, some even up by 50 per cent. Recruitment firms receive up to a five-fold increment in request for workers with up to 30 per cent higher salaries. This situation is then exacerbated by the temporary scheme that allows companies to hire foreign workers across sectors. Contractors reflected that profit margins have narrowed significantly with some turning in losses, which implies that the mid- to long-term impact would be even higher building and construction prices.

Read: COVID-19 impact on construction: Should idle migrant workers be reallocated to other industries?

Productivity drivers can obviously cut construction cost down to the minimum as they reduce the need for manpower and contractual duration. This includes the use of prefabricated prefinished volumetric construction (PPVC), refabricated bathroom units (PBU), design for manufacturing and assembly (DfMA) and integrated design delivery (IDD). All these fancy technologies are well-known for their effectiveness, but then again, the initial investment for the adoption would also be high.

In a nutshell, we could say that the cost drivers in construction in 2021 are material and labour provision, preliminaries, risk allowances, contractors’ profit margins, as well as new technology and methodology. Meanwhile, the regulators remain the same as in any other situations, such as market competition, project budget, benchmark rates and cost norms.

Loh then proposed some strategies for better results despite the challenges, with a focus in the procurement and tender calling, summarised as follows:

- Pre-qualifying and selecting tenderers carefully

- Reviewing tenderers financial strength, commitment and ability to deliver

- Keeping the space between stage 1 EOI (expression of interest) and stage 2 tender short

- Considering alternative procurement route if appropriate, e.g., cost plus, target cost, management contracting

- Soliciting alternative tender for contract duration nominated by the tenderer

- Allowing an adequate tender period

- Having a balanced PQM (price quality method) weightage for public budget

- Strategising with regular partners for a higher chance of winning

Read: PSSCOC contract administration: Key clauses to look out for in the new normal

Risk management is also a critical success factor that contractors and employers must look into carefully. They need to allow for a realistic contract period in light of the ongoing pandemic and provide relief for adverse legislated measures. They must also formulate cost-sharing for force majeure events, provide better payment terms for support cashflow, and consider less onerous liquidated damages for delay. – Anisa Pinatih, Construction+ Online

Disclaimer: Construction+ makes reasonable efforts to present accurate and reliable information on this website, but the information is not intended to provide specific advice about individual legal, business, or other matters, and it is not a substitute for readers’ independent research and evaluation of any issue. If specific legal or other expert advice is required or desired, the services of an appropriate, competent professional should be sought. Construction+ makes no representations of any kind and disclaims all expressed, implied, statutory or other warranties of any kind, including, without limitation, any warranties of accuracy and timeliness of the measures and regulations; and the completeness of the projects mentioned in the articles. All measures, regulations and projects are accurate as of the date of publication; for further information, please refer to the sources cited.

Hyperlinks are not endorsements: Construction+ is in the business of promoting the interests of its readers as a whole and does not promote or endorse references to specific products, services or third-party content providers; nor are such links or references any indication that Construction+ has received specific authorisation to provide these links or references. Rather, the links on this website to other sites are provided solely to acknowledge them as content sources and as a convenient resource to readers of Construction+.

Hong Kong

Hong Kong Singapore

Singapore Indonesia

Indonesia Tiếng Việt

Tiếng Việt ประเทศไทย

ประเทศไทย